Introduction

Success of any business depends on how well it has analysed its

external environment (micro and macro) and its own business. This understanding

is crucial for businesses to survive, sustain and reap advantages from

opportunities and to combat threats from external forces. An industry analysis

is of paramount importance for any business to analyse various trends, degree

of competition market share. Similarly, business can understand its own

strengths and weaknesses by addressing external threats and opportunities from

external market by through SWOT analysis.

In this backdrop, purpose of this article is to understand both

macro and micro environmental characteristics influencing on car dealership

market in Australia and then to develop a SWOT analysis for a top major players

in the industry and to make recommendations.

Figure 01.2 Environmental Analysis

Australian Car Dealership Industry

Though car brands were able to have a strong position in global

market they are now surpassed by other trending industries, such as apparel and

luxury items (Snyder, 2006) . However, global car

sales are growing at a rate of 4.8% and main reason for the growth is rapid

economic development in China (Scutt, 2017) . Chinese cars are

currently well popular among their own country, where in 2016 they were able to

manufacture and deliver over 28Mn auto mobiles (China Today, 2017) .

Similar to global growth trends, Australia too

experienced a turmoil in the industry. Despite volatile growth in car dealership industry[1]

for the last decade, the industry generated over $ 66 Billion revenue in 2017 (AADA, 2017) .

Figure

01.2 Car Dealership Industry Revenue Growth

In comparison to other developed markets,

Australian new car dealers face a fierce competition, where they offer 67

branded cars under franchising agreements, compared to 49 brands in Canada, 53

in the UK and 51 in the USA (AADA, 2017) . Among these brands

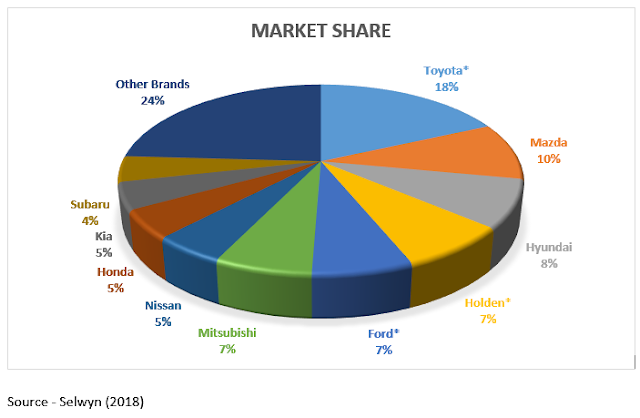

Toyota (18.2%) has the highest Australian market share (Selwyn, 2018) .

Market composition

Car dealership market in Australia is at its

maturity stage of the life cycle with an annual growth rate of 0.05%. In terms

of new car retailing, there are approximately 2,600 vehicle outlets operated by

1,500 car dealers in Australia (AADA, 2017) . Market comprised of

public listed companies such as AHG Ltd, AP Eagers Ltd and Autosports Group Ltd

and other small and medium enterprises (SME)s. It is noteworthy that this

market is not dominated by few companies nor it has a monopoly. However, in

2015 onwards the small car dealerships experienced a losses and have been

subject to acquisition by large companies.

Figure

01.3 Market Share in Terms of Brands

Competitors

Car dealership market has number of other

competitive industries such as used car dealerships, customer direct imports

and alternative public transport. The vehicle importation has been decreased

over the past decade steadily due to the strict government regulations. Total

used car imports were 12,000 in 2007 has been reduced to nearly a half by the

end of 2017 (RAWS Association,

2017) .

Figure 01.4 Market

Share in Terms of Companies

Despite the increase in number

of cars sold by dealers profit margins have shrunk due to low priced cars are

being in demand. The industry is having only 2% of net profit on revenue

compared to 5-7% of net profit margin in retail industries (Deloitte, 2016) . Thus for the

industry to boom there should be incentives for car dealers either by enhancing

the profit margin or by increasing the volume. Currently it is estimated that

growth of the car dealership market to be 0.05% (Thomson, 2018) . Current population

growth in country is 1.4% and the increase in migration population growth by 3%

(Australian Bureau of

Statistics, 2017)

could contribute immensely by widening customer base.

Suppliers

In terms of supply side of value chain, major

supply industries are vehicle manufacturing, wholesaling, electrical service

and parts and maintenance. Changes of these industry conditions could have a

direct impact on dealership market. Cessation of domestic car manufacturing of

by 2017 (Motor Trade Association of Australia, 2018) caused a

considerable impact on dealership market which brought new opportunities as

well as created threats.

Due to intense price competition among local car

manufacturers and imported cars owing to high wage rate, technological costs,

domestic production ceased in 2017. Thus, new car brands such as Toyota and GM

Holden are now solely imported. This has given car dealers new opportunity to

seek for low cost cars to capture wider margins which was not presented when cars

were locally manufactured.

Demand

Demand side of value chain is the customers. Industry

caters to diverse auto mobile requirements, ranging from; taxi and limousine

transport; passenger car rental and hiring and end retail customers. There are

over 400 models to choose from 67 branded cars, which gives customers wide

range of options. Thus competitiveness within the industry is undoubtably intense.

Due

to environmental concerns and increase in petroleum prices in last decade

customers are now moving towards more eco- friendly electric and hybrid

vehicles. Thus, small cars such as Mazda3, Hyundai i30 and Toyota Corolla have

reported a growth in sales (Thomson, 2018) . Despite

considerable reduction in fuel prices in recent years, customers still prefer

to switch to smaller-cheaper and fuel-efficient cars.

Contrariwise,

boom in SMEs has increased demand for utility and commercial vehicles (Thomson, 2018) , which are

comparatively more expensive than smaller-cheaper and fuel efficient cars. This

is supported by Toyota HiLux, being a commercially used vehicle, becoming the

best seller in year 2016-17.These utility vehicles can attract more profit

margins to dealerships as they are priced well above passenger vehicles.

02. Market

analysis

Demographic factors

The industry is currently at a

saturated point where there are nearly 685 cars per every 1,000 people in

Australia (Thomson, 2018) . Thus, unless the

population growth is increased demand for cars will be stagnant without a growth.

According to Figure03.2 most densely populated states, such as New

South Wales, Victoria and Queensland, are home to more than 77% of the

population. Conversely, little over 78% of the car dealers operated in these

regions.

While population and car

dealership distribution appeared to be rational, new opportunities could be

seen in states such as in Northern Territory and Western Australia, where there

is a considerable increase in population compared to the previous year. This

could be further supported by the new migration policies to direct the

immigrants to the low populated areas. Though the overall population growth in

Australia is at 1.6% the immigration growth is at 3%.

Figure

02.3 Population

and Car Dealership Distribution

Legal

Local dealers are facing a

challenge due to new amendments made to Motor Vehicle Standards Act 1989, which

enabled customers to personally import cars from 2018 onwards (SBS News,

2016; AADA, 2017) .

This has increased choice for customers while creating a threat to local car dealers.

With these changes in legislation, it is estimated that nearly 30,000 vehicles

be imported to Australia every year (RAWS Association, 2017) .

Further, Australian

Competition and Consumer Commission (ACCC) has restricted insurance

companies to pay 20% commission payment to car dealerships when selling

insurance policies to their customers (ACCC, 2017) . According to BDO

forecast this legislative influence could reduce the annual dealership income

by nearly $1,000 million.

Taxation

More than 20% of the price of car is comprised of

taxes and charges (AADA, 2017) . This includes, 10%

GST and 33% of the luxury car tax charged above luxury car threshold[1].

Thus, due to stoppage of car manufacturing in Australia all are imported which

are subject to additional importation taxes. As a result profit margins have

decreased.

Conversely, tax exemption of cars importing from

South Korea (since 2014) and Japan (since (2015) helped reduced the tension on

prices (Thomson, 2018) . Despite Australian

dollar being depreciating against these currencies, removal of the taxes caused

prices to be reduced in the market attracting more customers.

Environmental

The environmental concerns and go green concept is not a mere fad

among the producers. It has been firmly grounded in the today’s business models

due to reasons such as government, pressure groups influence, change in

consumer lifestyle and awareness, overwhelming evidence of human impact on environmental

degradation and also partly due to the companies genuine concerns on the

environment (Leonidou & Leonidou, 2011) . In contrast, some

businesses perceived environmental issue as an opportunity to exploit by

changing their strategies and to place their product top of competition (Curtin, 2007) . Due to these

reasons environment has a great impact on the industry at large and on

individual businesses.

Similarly industry too has an influence on environment. It is estimated that approximately 19% of carbon-dioxide

emission can be linked to vehicles on road (PricewaterhouseCoopers,

2007) .

With constant increase in the global temperature and awake of awareness, the

customers are now moving towards alternative transportation methods such as

public transport and the bicycles.

Economy

Real household income of Australian residence has

increased in the past decade by 19% [2]

(simple growth rate). When household income increases there is more demand is

created for the non-essential items like cars (Thomson, 2018) .

Since

the dealership market solely rely on the imported cars the exchange rate plays

a vital role. The weak Australian dollar has caused profits margins to shrink

and it was reported that most small scale car dealers in 2015 reported a loss.

However, major players like Automotive Holdings Group and AP Eagers maintain

steady growth.

03. Audit of Major Players in

the Car Industry

As discussed in the previous section Toyota, Mazda, Hyundai,

Holden and Ford are the top five brands in Australia in terms of the market

share. In this section two major players will be analysed in terms of their

marketing mix.

Toyota

Toyota[3] is

a Japanese car manufacturer founded in 1937. Today Toyota has fifty-one production

and nine R&D bases across the globe, including Australia. Unlike other

brands, Toyota does not recognize its country of origin, rather it states “Made

by Toyota”, which emphasises philosophy: every vehicle is produced with high

quality in “Toyota Way” (Toyota-Global, 2018) . The following

sections describe marketing mix of Toyota. Toyota-Australia is an unlisted

public company which is at the 38th position within the 2,000

companies in Australia (IBISWorld, 2017b) .

Product

Toyota-Global

categorised 42 models under 9 classes (Appendix1) compared Toyota-Australia

categorization of 21 models under 4 classes (Appendix2). The product mix in

Australia is comprised of vehicles that suitable for the lifestyle and the

legislative framework. Since the cessation of the production of manufacturing

in Australia in 2017, all the vehicles are imported for the local market.

The

demand for large vehicles have been diminished which could be seen by gradual

decline in sale of Aurion[4] (Thomson,

2018)

and discontinuation of the production. Similarly, the importance placed on

medium cars declined (Camry) due to shift in consumer preference for small cars.

As a result demand for Corolla has increased. In particular large passenger vehicles

(Tarago) demand has decreased owing to high fuel consumption. Similarly grow in

SME businesses has created a great demand for utility (HiLux) and commercial

(HiAce) vehicles.

Thus

in terms of the product mix a greater emphasis has been placed on utility, small-fuel

efficient and commercial vehicles.

Price

Price is the only element in the marketing mix that does not

entail an actual cost to the business (Rao & Steckel, 1995) . In 2017

Toyota-Australia generated $8,827,889,000 revenue. This

is from the full range of low priced to premium models. The pricing model is

designed based on the model and customer segmentation.

Due to high competition among dealers and higher range of customer

choices, the pricing strategy has been the economy pricing for the

small-fuel-efficient vehicles and for luxury models, premium pricing strategy

has been applied. However, the pricing strategy has been revised for Toyota86

sports car model by lowering its price in order to popularise the product in

Australia (Thomson, 2018) .

Japan-Australia free-trade-agreement has removed the

import tax on vehicles. Toyota being a Japanese company were able to receive

the benefit of the government policy and lower their prices to gain the

competitive edge (IBISWorld, 2018) . As a result, lowering

the price of sports car category (Toyota86) has

attracted more customers.

Promotion

Toyota has branded itself as “making clean-cars” (Toyota-Global, 2018) . The advertising

strategies have been designed to emphasised qualities of different models. For

instance slogans such as “Hilux-tougher than you think” Yaris-treat it with

respect, “Prius-lower

emissions than a goat” encapsulates features and value of models. Toyota’s

commercial sponsorship has been driving force of their brand image. Among their

sponsorship policies they embrace innovative

environmental reliability safety high and quality (Toyota-Global, 2018) .

Place

Distribution channel is greatly dispersed as Toyota uses 313

dealerships to reach the customers dispersed across the country.

When

the dealership distribution is compared with the population it can be seen that

both has the same degree of dispersal.

Figure 03. 4 Distribution of Toyota Dealerships

Vs Population

Mazda

Mazda-Australia, which has its roots in Japan, is

a foreign owned private company which is at the 119th position

within the 2,000 companies in Australia (IBISWorld, 2017a) . It generated a

revenue of $3Mn including the sale of vehicles and other revenue.

Product

Mazda-Global categorised 11 models under 5

classes (Appendix3) and Mazda CX8, a large SUV model is about to be introduced

to their product range. Unlike Toyota, Mazda is well known for its product for

being made for passion and people with passion. The product designs are much

towards sports car models than for family-type wagon.

As a result of consumers shifting towards low

priced-small cars, demand for Mazda3 has been increased creating more emphasis

on their product range. Mazda is well known for its SUVs (CX5 and CX9) and

there has been a recent increase in demand among upper-middleclass buyers.

Price

The prising is very competitive as there are number of models are

in the market under numerous brads. Mazda follows different pricing strategies

based on the target market, for instance CX9 is a premium priced vehicle

targeted for upper-middleclass buyers

whereas Mazda3 is following competitive pricing strategy with lower prices to

increase the profits by increasing the volumes.

Promotion

Zoom-Zoom slogan has been the heart of the promotional campion of

Mazda since 2010. This represents Mazda’s fuel efficient SkyActiv engine. Among other promotional strategies Mazda aggressively

take part in commercial sponsorships. It has been the sponsor for number of

sporting events and gained popularity.

Recently, Mazda-Australia has a range of drive away offers for the

private buyers. Further Mazda has introduced an end-of-year tax time value for

a limited time period as a method of promotional strategies.

Place

Mazda manufacturing in different plants across the country and

imported to Australia. Having affiliations with dealerships provided Mazda with

competitive edge by being close to the target customers. Unlike other brands,

Mazda targets the urban youth in upper and middle-class-upper

04. Recommendation

Change in the product mix

In the review of information related to

Toyota-Australia it was noted that popularity for small-fuel efficient cars is

now in demand due to shift in customer preference. Further it was noted that

Australia is not importing all the product ranges available to the global

market. Out of a

total of 42 models only 21 models are available in Australia. Thus, it is recommended that Toyota-Australia

expanded its product mix by importing brands such as Mirai, Prius Plug-in Hybrid and electronic car

model iQ EV, which is an ultra-compact size car.

Conversely, it was noted that the

demand for the commercial and utility vehicles have been increased due to the

growth in the SME businesses. Thus, enhancing the product mix in Australia by

making the models such as Dyna, Tacoma and Tundra could help capture a growing

market.

Change in regulations

As discussed before from 2018 onwards

individuals are permitted to import vehicles to Australia without the necessity

to go through a dealer. In this regard, also it is recommended to increase the

models available for customers.

Segmentation

According to Stilinovic

(2016) and Guthrie (2017), New South Wales has 9 suburbs out of the most

expensive 10 suburbs in Australia, which includes Point Piper, Darling Point, Cremorne Point, Bellevue Hill the only other

suburb is Toorak in Victoria. Thus, it is recommended to focus on the

high-end vehicles and introduce WAKU-DoKI,

new sports car to Australian market.

Under environment analysis it was noted

that utility and commercial vehicles are in demand due to the growth in SMEs.

It is mostly in urban areas SMEs are opened and operated. Therefore it is

advisable to focus on promoting these types of vehicles in the urban areas. Conversely,

young people resettle in low-rent suburbs. As per previous analysis it is

understood that this age group prefers low-cost-fuel-efficient vehicles. Thus,

another recommendation could be to increase the small cars range and promote

them in low rent suburbs.

High-end cars

The industry is now saturated with 0.6

cars per every person. Thus, demand will not be increased unless population is

increased. Therefore it is recommended that Toyota to focus on delivering

high-end cars for car collectors and for upper-class consumers. This could

compromise the low margins gained from small-passenger vehicles.

05. Conclusion

This report analysed the car dealership market

in Australia. For this purpose, PEST analysis is used for external macro

environment, Industry analysis for micro environment and SWOT analysis is

employed to analyse the selected dealer-Toyota-Australia. It was understood

that market is at its maturity stage and saturated with 0.6 cars per person and

0.05% growth rate. Market faces a fierce competition due to high-concentration

and shift in customer demand towards low cost vehicles with thin margins.

The industry experienced number of changes

in external market such, as cessation of vehicle manufacturing in Australia,

deteriorating Australian Dollar, change in government policies relating to

importation of vehicles and commission earned by dealerships. These changes at

it face is unfavourable. Conversely, tax free agreements with major importers, consumer

shift towards eco-friendly vehicles, boom in SME created new opportunities.

Toyota-Australia, being the market leader has

a product range to cater to its different market segments. For pricing, they

follow economic pricing for low-cost-fuel-efficient vehicles and premium pricing

for high-end vehicles. Among promotional mix personal selling, through

dealerships, mass advertisements, public relations and sales promotions can be

highlighted as major strategies. Dealership has been the primary means of

distributing the vehicles, which gives opportunity to provide differentiated

approach to the market segment.

Finally, recommendations were put forward after the

analysis. Firstly, it is advised to increase the product mix offered in Australia

to address threats faced by Toyota-Australia. Secondly, to focus on types of

promotional strategies based on the demographic characteristics of customers.

In this regards more emphasis should be placed for small cars in low-rent

suburbs, luxury cars in expensive suburbs and utility and commercial vehicles

in urban areas.

06.

References

AADA. (2017). Pre-Budget

Submission. Parkes, Australian Capital Territory: Australian Automotive

Dealer Association [AADA].

ACCC. (2017, March 9). Australian

Competition and Consumer Commission [ACCC]. Retrieved from ACCC denies

authorisation for insurance companies to jointly set a cap on sales

commissions:

https://www.accc.gov.au/media-release/accc-denies-authorisation-for-insurance-companies-to-jointly-set-a-cap-on-sales-commissions

Australian Bureau of Statistics. (2017). Migration,

Australia, 2015-16. Australia: Australian Bureau of Statistics.

Australian Bureau of Statistics. (2018 ).

Australian Demographic Statistics, Sep 2017. Canberra: Australian

Bureau of Statistics.

China Today. (2017, Jun). China's Own Car

Brands. China Today, pp. 7-7. 1/4.

Curtin, T. (2007). Managing Green

Issues. New York, NY: Palgrave Macmillan.

Deloitte. (2016). Motor Industry

Services - 2016 Dealership Benchmarks. Australia: Deloitte.

Guthrie, B. (2017, December 15). Australia’s

most expensive suburbs in 2017. Retrieved from realestate.com.au:

https://www.realestate.com.au/news/australias-most-expensive-suburbs-in-2017/

IBISWorld. (2017a). Mazda Australia

Pty Limited. Australia: IBISWorld.

IBISWorld. (2017b). Toyota Motor

Corporation Australia Limited. Australia: IBISWorld.

IBISWorld. (2018). Motor Vehicle

Dealers in Australia. Australia: IBISWorld.

Leonidou, C. N., & Leonidou, L. C.

(2011). European Journal of Marketing, 45(1/2), 68-103.

Mainz, U., & Khare, A. (2000).

Planning for an environment-friendly car. Technovation, 20(4),

205-214.

Motor Trade Association of Australia.

(2018). Automotive Industry in Australia. Retrieved from Motor Trade

Association of Australia: https://www.mtaa.com.au/industry-activity/31-automotive-industry-in-australia

PricewaterhouseCoopers. (2007). The

automotive industry and climate change : Framework and dynamics of the CO2

(r)evolution. Stuttgart: PricewaterhouseCoopers.

Rao, V. R., & Steckel, J. H. (1995).

A Cross-Cultural Analysis of Price Responses to Environmental Changes. Marketing

Letters., 5-14.

RAWS Association. (2017). Regulatory

inpact of proposed government road vehicles standards bill 2017.

Australia: RAWS Association.

Saxby, C. L., Peterson, R., &

Abercrombie, C. L. (1995). Selecting marketing strategy through environmental

analysis. Journal of Marketing Management, 5(1), 16-20.

SBS News. (2016, February 10). Personal

imports of new cars from 2018. Retrieved from SBS News: https://www.sbs.com.au/news/personal-imports-of-new-cars-from-2018

Scutt, D. (2017, January 17). 2016 was

a record-breaking year for global car sales, and it was almost entirely

driven by China. Retrieved from Business Insider Australia:

https://www.businessinsider.com.au/2016-was-a-record-breaking-year-for-global-car-sales-and-it-was-almost-entirely-driven-by-china-2017-1

Selwyn, B. (2018, February 12). January

2018 Vehicle Sales – Trends in the Australian Motor Vehicle Market.

Retrieved from Aca Research: https://www.acaresearch.com.au/australian-market-research-blog/january-2018-vehicle-sales-trends-in-the-australian-motor-vehicle-market

Snyder, J. (2006, May 15). Study: Car

brands are strong -- but fading. Automotive News, pp. 32D-32D.

Stilinovic, M. (2016 , June 11). The 10

Most Expensive Suburbs In Australia. Forbes, pp. 1-2.

Thomson, J. (2018, April). Motor

Vehicle Dealers in Australia. Retrieved from IBISWorld:

http://clients1.ibisworld.com.au.mit.idm.oclc.org/reports/au/industry/default.aspx?entid=434

Toyota-Australia. (2018). Dealer

locator. Retrieved from Toyota:

https://www.toyota.com.au/find-a-dealer#WA

Toyota-Global. (2018). Company Profile.

Retrieved from Toyota-Global:

http://www.toyota-global.com/pages/contents/company/profile/overview/pdf/companyprofile_2017e.pdf

Toyota-Global. (2018). Globalizing and

Localizing Manufacturing. Retrieved from Toyota-Global:

http://www.toyota-global.com/company/vision_philosophy/globalizing_and_localizing_manufacturing/

[1] The threshold for

2017-18 for the fuel efficient vehicles is $75,526 and for the other vehicles

is $66,331

[2] Mean weekly equalised disposable household income in 2016 is

$1,009 compared to 2005 is $843 (Australian Bureau of Statistics,

2017)

[3] Formally known as Toyoda

[4] Toyota Aurion is an Australian made car which was ceased its production

in 2017

[1] “Motor

Vehicle Dealers industry includes dealerships primarily engaged in selling new

or used motor vehicles to consumers, companies and government entities” (Thomson,

2018, p. 2) . The industry also includes the after sales

services to their customers. Thus, market composed of:

-new

car retaining,

-used

car retailing and

-after-sales

services.

No comments:

Post a Comment